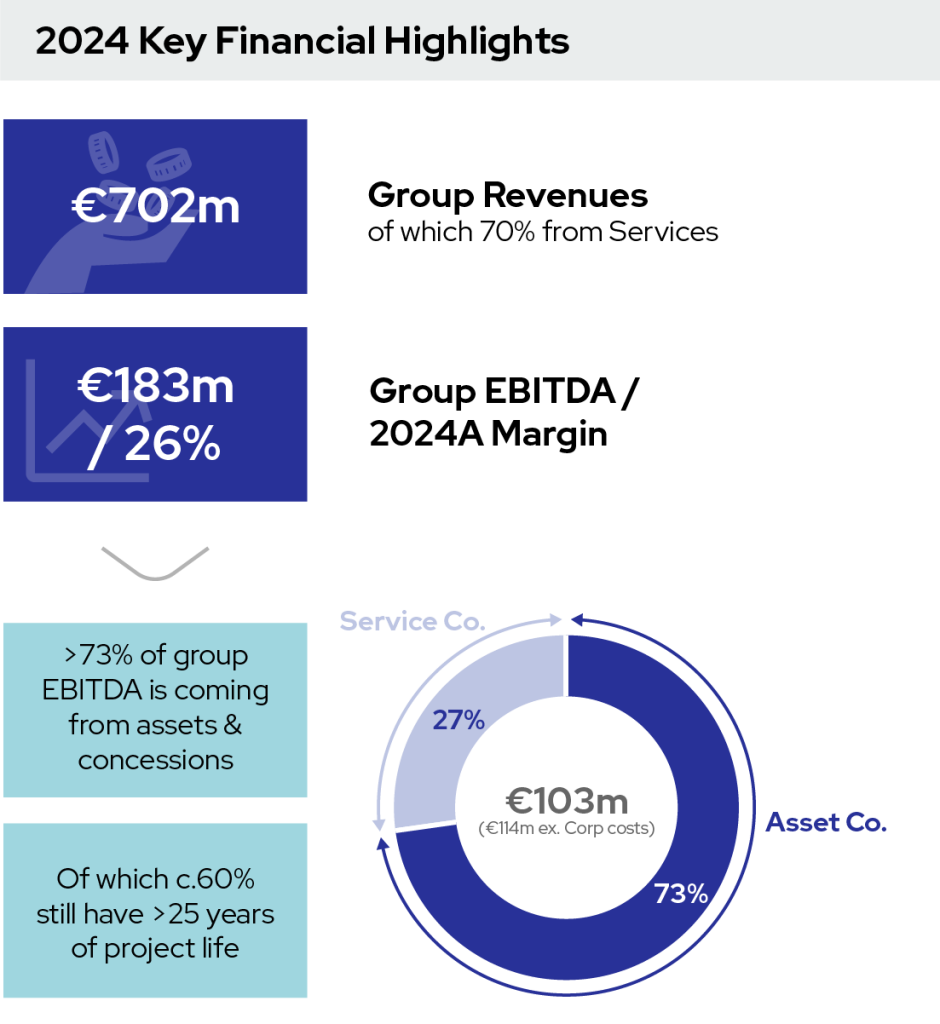

Focus on build-to-own strategy across water and energy

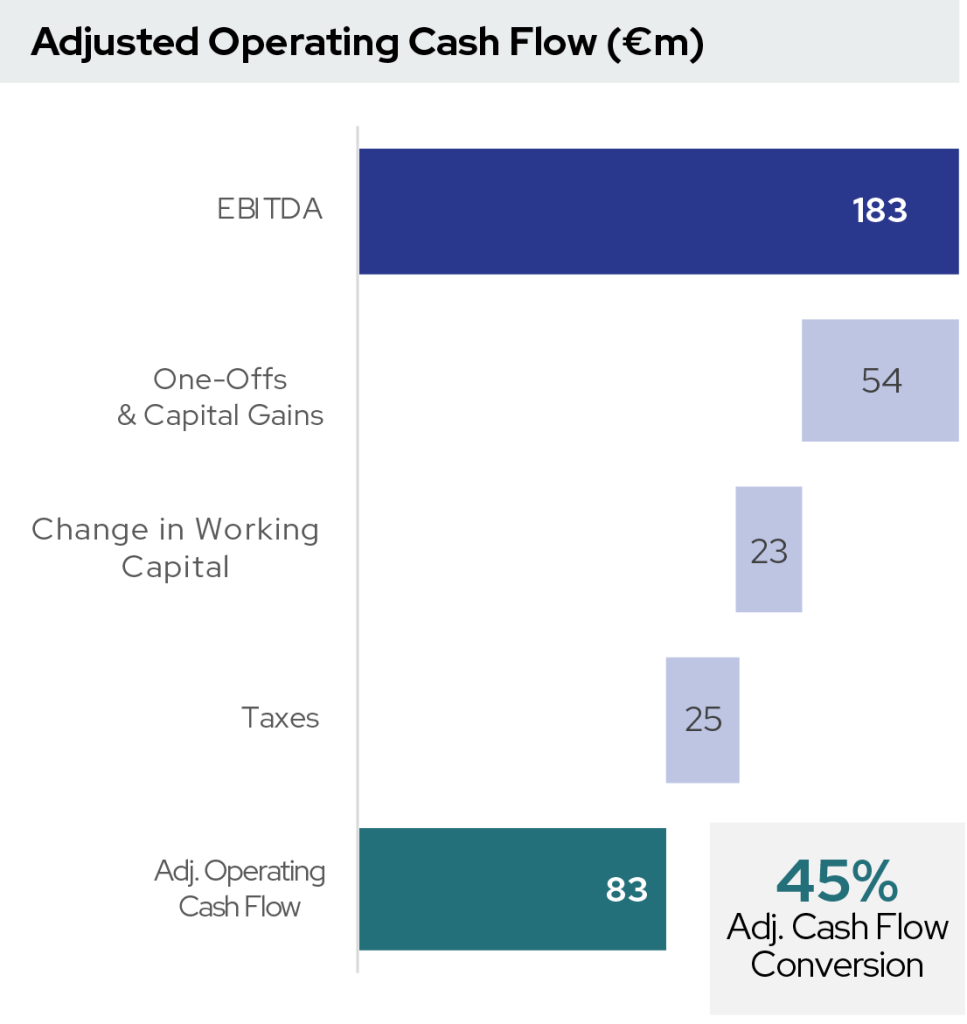

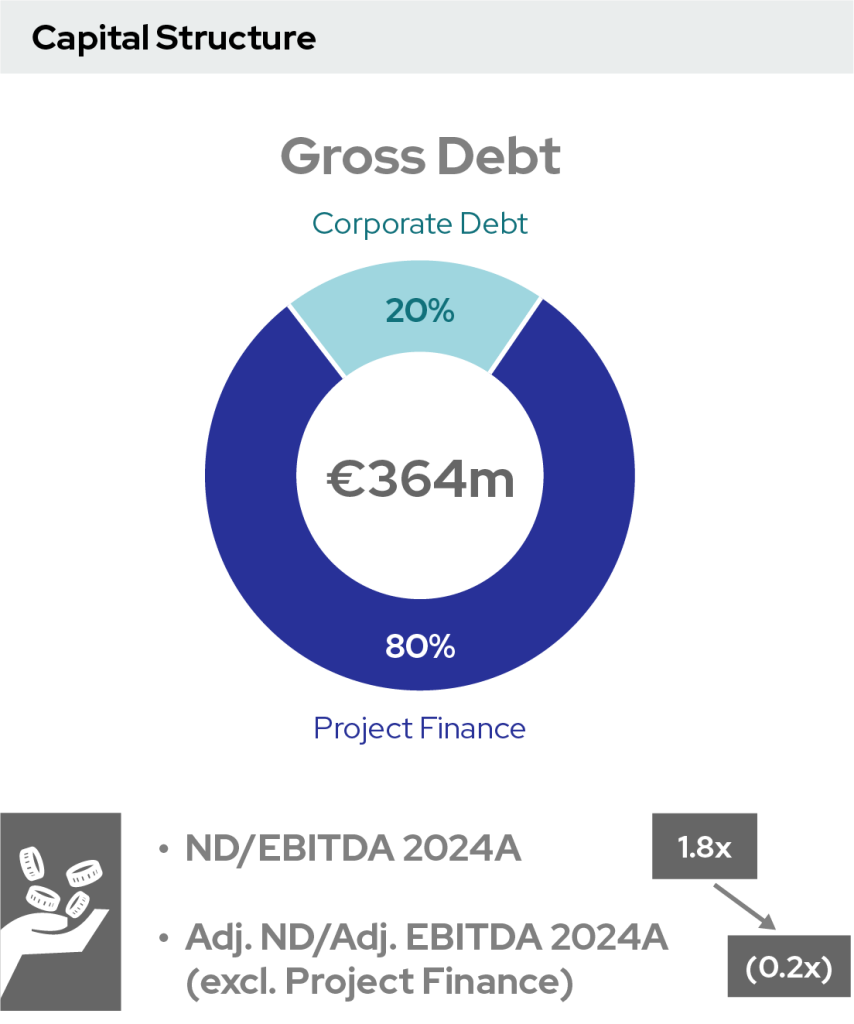

Note: Abengoa S.A.’s productive units have only been consolidated within the Company’s results since the date on which the acquisition took effect pursuant to the terms of the Share Purchase Agreement (April 18, 2023). Therefore, the Group’s consolidated statement of income and the Group’s consolidated statement of cash flows for the year ended December 31, 2023 include (i) twelve months of operations of the Company and (ii) approximately nine month of operations of the Abengoa productive units. 1) EBITDA is an APM calculated as the sum of Operating profit and Amortization and charges due to impairments, provisions and amortizations. EBITDA excluding corporate costs (-€11m). 2) Adjusted operating cash flow is an APM calculated as EBITDA less changes in working capital, capital expenditures and taxes. 3) Debt with recourse sitting at corporate level, composed of debt with credit institutions and lease liabilities. 4) Debt without recourse sitting on the 2 water concessions and SPP1 energy Project. 5) Net Debt/EBITDA is an APM calculated as Net Debt defined as the sum of the Group’s Debt with credit institutions and others and Project finance debt minus Cash and cash equivalents) divided by EBITDA. 6) Adj. Net Debt/ Adj. EBITDA is an APM calculated as Adjusted Net Debt (comprised of debts with credit institutions, plus lease liabilities and other financial liabilities, less cash and cash equivalents) divided by Adjusted EBITDA (comprised of EBITDA excluding concessions). 7) €103m reported EBITDA includes corporate and other costs (-€11m). EBITDA split by business unit is calculated over EBITDA excluding corporate costs (€114m). 8) Calculated as EBITDA contribution of Agadir’s two water concessions and Brazil bioenergy project, all divided by Group EBITDA excluding corporate costs. 9) Normalized Cash Flow Conversion is an APM calculated as Adjusted Operating Cash Flow minus one-off working capital expenses pertaining to the Centro Morelos, Dewa, Agadir, Salalah, Rabigh and Taweelah projects. These one-off working capital expenses pertain to expenses incurred prior to the acquisition of Abengoa S.A.’s productive units.